Table of Contents

- UPDATED VERSION PART 6 $OXY— STOCK & OPTION PLAY NEED IT TO BREAK OVER ...

- Warren Buffett Keeps Doubling Down on Occidental Petroleum (OXY) Stock ...

- Occidental Stock: Is It A Buy Below Berkshire's Average Purchases ...

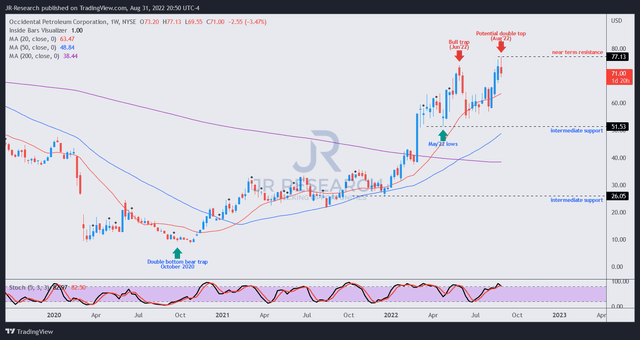

- Occidental Stock: Another Fantastic Selling Opportunity (NYSE:OXY ...

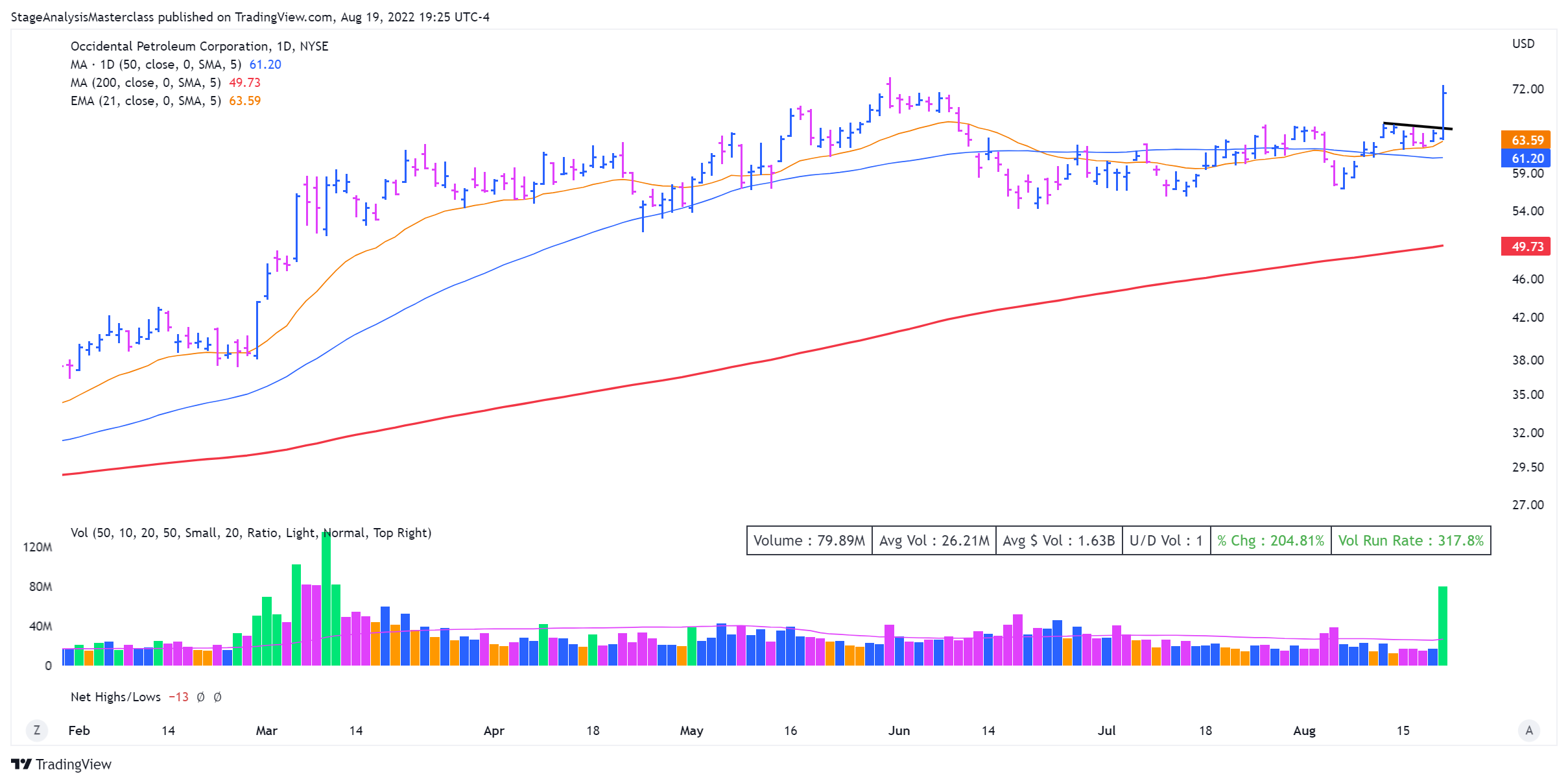

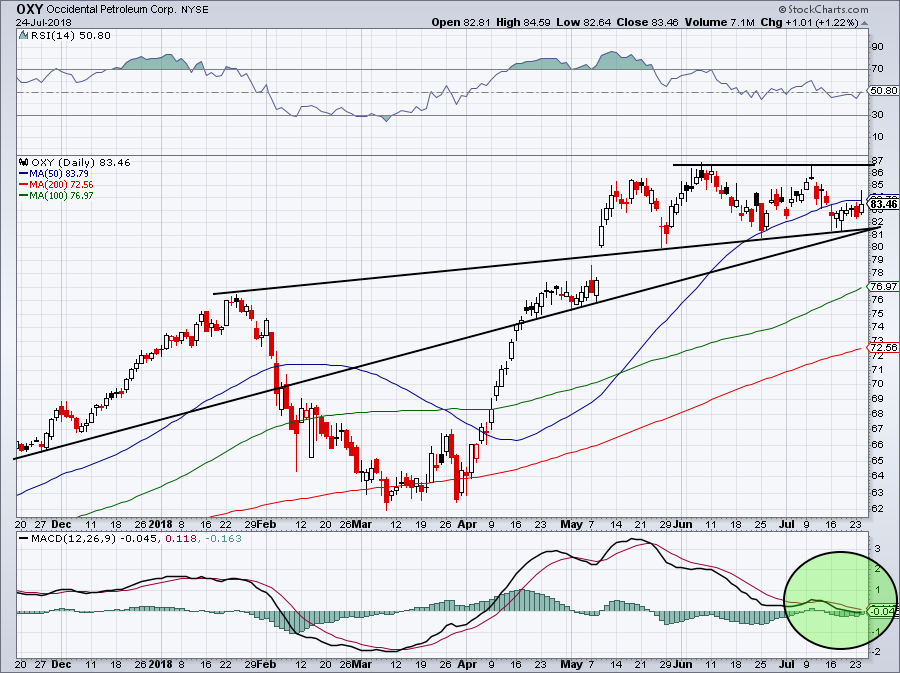

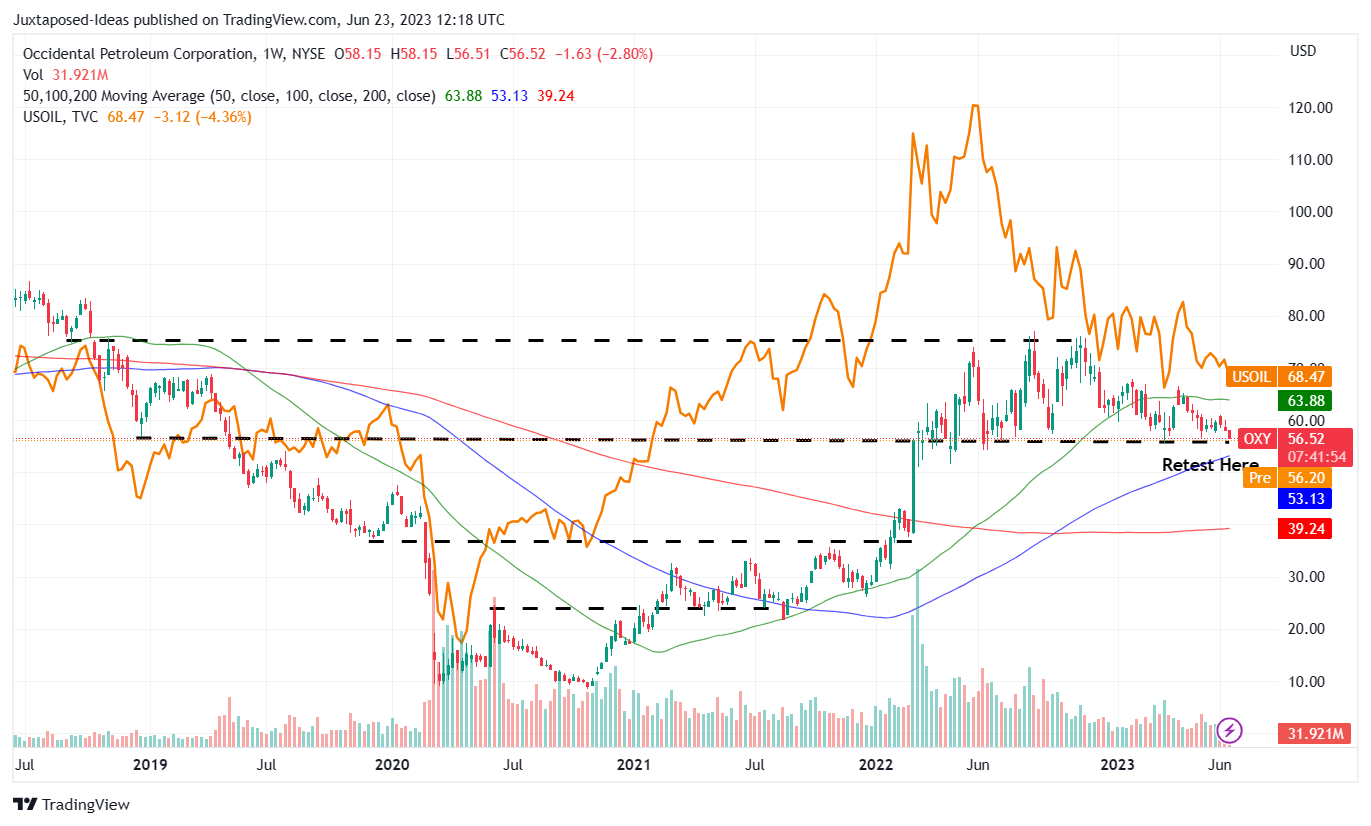

- OXY Stock and Chart Analysis - by Richard Moglen

- OXY Stock Forecast 2024: Occidental Petroleum Q1 Performance and Outlook

- OXY Stock Starting to Regain Its Mojo After Adopting Leaner Model ...

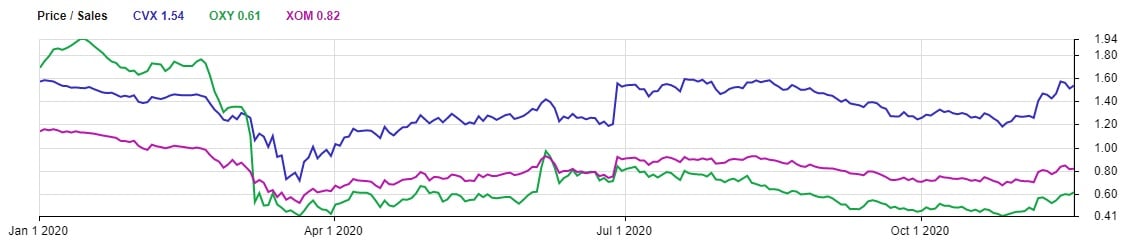

- Occidental Petroleum Is Well Below Tangible Book Value | Markets Insider

- 3 Reasons to Consider Buying Occidental Petroleum Stock Right Now ...

- Is Occidental Petroleum (NYSE: OXY) Stock a Buy Now? - TipRanks.com

Company Overview

Stock Price and Performance

In terms of performance, OXY stock has underperformed the broader energy sector in recent months, with a year-to-date return of around -10%. However, the company's long-term prospects remain promising, driven by its diversified portfolio of assets, strong balance sheet, and commitment to sustainable growth. With a dividend yield of around 8%, OXY stock offers an attractive income stream for investors seeking regular returns.

Investment Outlook

So, is Occidental Petroleum stock a good investment opportunity? The answer depends on your individual investment goals and risk tolerance. While the energy sector is inherently volatile, OXY's strong track record, diversified operations, and commitment to sustainability make it an attractive option for investors seeking exposure to the industry.Some key factors to consider when evaluating OXY stock include:

- Dividend yield: OXY's high dividend yield provides a regular income stream, making it an attractive option for income-seeking investors.

- Operational efficiency: The company's focus on cost reduction and operational excellence positions it well for long-term success.

- Sustainability: OXY's commitment to reducing its environmental footprint and promoting sustainable practices aligns with the growing demand for responsible investing.

- Geopolitical risks: As a global energy company, OXY is exposed to geopolitical risks, which can impact its operations and stock price.